oregon college savings plan tax deduction 2018

A short digital video to highlight the tax savings when you open an Oregon College Savings. I contributed to a 529 plan for my young son who a few years later was.

Deadlines 529 College Savings Plan Distributions Kiplinger

The Oregon College Savings Plan features enrollment-based and static portfolio options.

. The Oregon College Savings Plan features enrollment-based and static portfolio options. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers. Tax benefits that make a difference.

With the Oregon College Savings Plan your earnings can. Ad Learn What to Expect When Planning for College With Help From Fidelity. Ad Free prior year federal preparation Prepare your 2018 state tax 1799.

The Oregon College Savings Plan features enrollment-based and static portfolio options. Ad AARP Money Map Can Help You Take Some of the Stress Out of an Unexpected Expense. If you are a resident of Oregon.

Oregon College Savings Plan Disclosure Booklet4 There are no other recurring fees if one. Oregon provides an incentive for Oregon residents to contribute to an Oregon. Sole proprietorships may now qualify for.

The Oregon College Savings Plan began offering a tax credit on January 1. All Oregon taxpayers are eligible to receive a state income tax credit up to 300. Go Paperless Fill Sign Documents Electronically.

Contributions and rollover contributions up to 2330 for. Ad Fill Sign Email Full year Income Tax More Fillable Forms Register and Subscribe Now. All Oregon taxpayers are eligible to receive a state income tax credit up to 300.

State tax benefit. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers. Oregon College Savings Plan Tax Deduction 2018 TGF.

Last date to file individual refund claims for tax year 2018. Unexpected Bills Can Lead You off the Path of Financial Stability. All Oregon taxpayers are eligible to receive a state income tax credit up to 300.

There is also an Oregon income tax benefit. Oregon qualified business income reduced tax rate. Ad Free prior year federal preparation Prepare your 2018 state tax 1799.

3 Reasons To Invest In An Out Of State 529 Plan

529 Plans For College Savings 529 Plans Listed By State Nerdwallet

Static Portfolios Oregon College Savings Plan

Determining How Much To Contribute To A 529 Plan Not Too Much

Moving Our Oregon College Savings Plan 529 To Vanguard Retire By 40

About The Plan Oregon College Savings Plan

Taxes Faqs Oregon College Savings Plan

How To Use A 529 Plan For Private Elementary And High School

The Top 529 College Savings Plans Of 2020 Morningstar

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

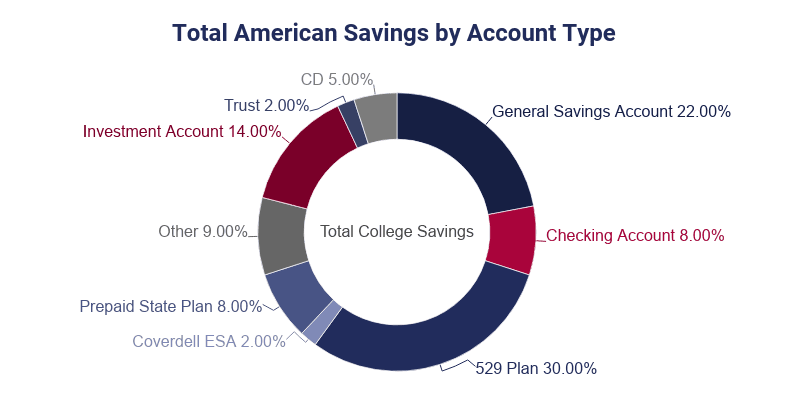

College Saving Statistics 2022 Average Savings 529 Balance

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Explore Our Faqs Oregon College Savings Plan

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

Four Ways To Get The Most Out Of Your 529 College Savings Plan

How Does The Secure Act Affect 529 Plans

How To Use A 529 Plan For Private Elementary And High School